- What is Estrella Insurance?

- Is Estrella Insurance a franchise opportunity?

- Facts That Nobody Told You About Estrella Insurance

- Estrella Insurance Franchise Requirements

- How much does an Estrella Insurance franchise cost?

- How much do Estrella Insurance franchise owners make?

- Estrella Insurance Training for Franchises

- Estrella Insurance Operations to Franchises

- How is Estrella Insurance Territory Granted to Franchises?

- What is the term of the franchise agreement and renewal?

- Does Estrella Insurance provide financial assistance to franchises?

- Pros and Cons of Buying an Estrella Insurance Franchise

- What are Estrella Insurance franchise reviews?

- Estrella Insurance Rankings

- Franchise Deck Analysis and Overview

- Estrella Insurance Franchise Success and Failure Rate

- Competition Analysis of Estrella Insurance

- Conclusion: Should You Buy the Estrella Insurance Franchise for Sale?

- Frequently Asked Questions (FAQs)

Estrella Insurance is one of the most popular and trusted insurance brands in the industry, and it’s no wonder why. With a range of sought-after products like life insurance, health insurance, and car insurance, the Estrella franchise has been helping families and businesses protect what matters most for decades. But starting a franchise of Estrella comes with its own set of challenges. That’s why we’ve put together this guide to Estrella Franchise Cost, Profit, Review, and Opportunities now. I want to make sure that you have all the information you need to get started on your journey as a franchise owner of Estrella Insurance.

So whether you’re looking for a thorough overview of the financial benefits of joining this franchise or a comprehensive review of its policies and procedures, this guide is the perfect place to start. Let’s dive in!

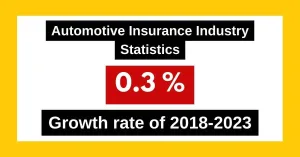

According to IBISWorld, the market size of the Automobile Insurance industry in the US has declined 0.3% per year on average between 2018 and 2023.

What is Estrella Insurance?

Are you looking for a way to join the franchise revolution? Estrella Insurance is the answer. This rapidly growing franchise focuses on helping people find affordable auto insurance and protect their investments. With Estrella’s commitment to great customer service and competitive rates, it’s no wonder why so many are choosing this company for their insurance needs.

Estrella Insurance has been around for over 10 years and has continually expanded its services over the years. Through their network of agents, they offer comprehensive auto insurance packages that include full-coverage car insurance, motorcycle and boat coverage, and liability coverage at competitive rates.

In addition, Estrella Insurance offers a variety of additional services to help protect customers’ investments. These services include accident forgiveness, non-owner insurance policies, umbrella policies, roadside assistance, and more. The company also provides access to a variety of discounts that can further lower premiums.

Estrella Insurance has experienced significant growth recently. In 2021, the company saw double-digit growth of more than 15% in premiums, which led them to surpass the $500 million system-wide premium mark for the first time in its 40-year history.

This year, Estrella is on pace to exceed $600 million in premiums. They have also been named to Entrepreneur’s Franchise 500 for the 11th consecutive year, which evaluates franchisors based on aspects like cost and fees, size and growth, support, brand strength, and financial strength.

Is Estrella Insurance a franchise opportunity?

Estrella Insurance is a great franchising opportunity for entrepreneurs interested in getting into the insurance business. Founded in 1988, Estrella Insurance has been providing quality coverage and excellent customer service for over thirty years. With over 100 locations nationwide, Estrella Insurance is one of the leading insurance companies in the country.

If you’re looking for a solid and dependable franchising opportunity, Estrella Insurance is an excellent choice. Here’s why

- Quality Coverage

Estrella Insurance offers competitive rates and detailed coverage plans for a wide range of insurance services. Their policies are backed by leading industry experts to ensure that customers get only the best coverage available. This makes them an ideal choice for both individuals and businesses who want to make sure they are well-protected against any unforeseen circumstances.

- Excellent customer service

Estrella Insurance has a team of trained professionals who are dedicated to providing top-notch customer service. They make it their mission to ensure that each customer is satisfied with their policy and coverage options, offering personalised advice tailored to their individual needs.

- Low franchise costs

The costs associated with opening an Estrella Insurance franchises are relatively low compared to other franchises in the industry. The startup costs are just a fraction of what you would see with other insurers, making it an affordable option for those looking for a great business investment opportunity.

Facts That Nobody Told You About Estrella Insurance

If you’re interested in joining the Estrella Franchise Revolution, you may find that you need to know a few facts that nobody told you about.

- Investment Costs

Estrella Franchise requires a $25,000 investment fee in addition to working capital. You’ll also need to pay other fees and expenses, such as marketing costs, equipment costs, and royalty fees. The exact amount and terms of these fees will depend on your individual location and offerings.

- Benefits of an Estrella Franchise

A major benefit of franchising with Estrella Insurance is their commitment to helping you succeed. They provide training and support, access to proprietary systems, and branding opportunities. Additionally, they offer special promotions, discounts, and rewards for signing up with the company.

- Success Stories

There are many success stories related to Estrella Insurance Franchises —for example, one owner has been able to increase their profits in a little over a year! With the right strategy and dedication, there’s no telling how much money you could make through this business opportunity.

| Estrella Insurance Franchise Review and Information | |

| Industry Type | Business Services Franchises |

| Sub Category | Financial Service and Insurance |

| Year Established | 1980 |

| Company Name | Estrella Insurance Inc |

| Founder/Management Head | Nicolas Estrella |

| Franchising Started | 2008 |

| Employees at Company H.O | <25 |

| Franchise Expansion Plan | This company is offering new franchisees in the many US states |

| Number of Units | 186 |

| Number of Franchise Units | 126 |

| Social Media Handles | |

| Youtube | |

| Company Office location | 3750 W. Flagler St.Miami, FL 33134 |

Estrella Insurance Franchise Requirements

Estrella Insurance is a great opportunity for entrepreneurs and business owners who want to be part of the growing insurance industry. However, there are some requirements that you need to meet in order to join the franchise revolution.

- Capital Required

Estrella Insurance offers a variety of franchise packages to fit the needs of different potential business owners. Depending on the size of the business, location, and number of locations, potential Estrella Insurance franchisees can expect to invest anywhere around $49,500 in start-up costs. This includes all necessary items like licensing fees and administrative costs.

The initial franchising fee is also dependent on the location and size of the business. For example, in some locations, a small-business owner may need to pay an initial franchising fee of $25,000.

- Real estate requirements

In order to open a new Estrella franchise, you’ll need to lease or purchase an appropriate space for your office. The size of your space will depend on several factors, such as the number of employees that you plan to have and whether or not you offer additional services such as financial advice.

- Franchise Agreement

When you join Estrella Insurance, you will need to sign a agreement that outlines all of the terms and conditions that must be met in order for the franchise relationship to be successful. This document will contain information such as territory rights, royalties, and other important legal matters.

- Training and Support

Estrella Insurance provides comprehensive training and support programmes for their franchisees. This includes everything from marketing and promotional efforts to operational training and tech support. That way, every Estrella franchise owner has access to the resources they need to successfully run their business.

How much does an Estrella Insurance franchise cost?

Starting an Estrella Insurance franchises requires a total cost of about $49,500 and includes the initial franchise fee of $25,000 as well as other startup costs like rent and equipment.

The total investment required for an Estrella franchise will also vary based on several factors, such as marketing costs and local fees. Potential franchisees should also consider the ongoing costs associated with maintaining a successful insurance business, including marketing fees, personnel costs, and insurance premium payments.

In addition to start-up and ongoing cost considerations, potential Estrella Insurance franchisees should consider additional costs such as training fees and other costs associated with setting up a storefront. A thorough understanding of these costs is essential for anyone considering investing in an Estrella franchise business.

| Estrella Insurance Franchise Price and Costs | |

| Estrella Insurance Franchise Fee | $25,000 |

| Estrella Insurance Franchise Cost | $12,250 to $84,000 |

| Royalty Fee | 10-14% |

| Advertising Fee | 7% |

| Term of Agreement | 10 years |

| Is franchise term renewable? | Yes |

| Renewable Franchise Fees |

How much do Estrella Insurance franchise owners make?

One question many potential Estrella Insurance franchise owners are asking is, “How much do I stand to make by investing in an Estrella Insurance franchise?” Well, the short answer is, it depends.

Most Estrella Insurance franchises cost anywhere around $49,500 to launch and operate for the first year. While this may seem like a lot upfront, keep in mind that it can be financed, or at least partially financed, through the SBA 7A loan program. With this in mind, you might be wondering how much money you stand to make from owning an Estrella insurance franchises.

The good news is that the average return on investment for Estrella Insurance franchise owners is between 10% and 25%. That means that if you open an Estrella Insurance franchises with an initial investment of $49,500, you could make upwards of $25,000 in your first year of operation. And franchise owners who have been around for more than two years report returns as high as 40%!

At Estrella Insurance, we take great pride in providing our owners with the most comprehensive support system possible so they can maximise their potential earnings. With a combination of excellent products and services to offer customers, along with our business management systems and marketing strategies tailored to each individual market area, Estrella Insurance has all its bases covered when it comes to helping each owner reach their fullest potential.

Estrella Insurance Training for Franchises

If you’re looking for an insurance business that has quality training, Estrella Insurance is worth a look. Estrella provides quality training to all its franchises, helping them succeed and provide the best service to customers. The company offers both online and in-person training courses on a variety of topics, including sales techniques, customer service, manual writing, and more.

- Online Training

Estrella Insurance offers several online training modules that are designed to provide key information and best practises to help franchises thrive in their businesses. All training materials are accessed through the platform’s learning management system, which is designed to increase retention rates by providing an interactive experience. Some topics covered include:

- Learning the basics of customer service

- Understanding insurance policies and laws

- Developing sales skills

- Training in marketing methods

- In-Person Training

In addition to the online modules, Estrella Insurance also provides all its franchises with in-person training at the company’s headquarters or at other predesignated locations. This helps franchisees get comfortable with Estrella’s products and services before taking them out into the world. Franchises have access to coaches who can guide them through their new business venture, giving them a better chance for success.

Overall, Estrella Insurance offers quality training programs for its franchises so they can have better insight into the insurance industry and help provide customers with the best service possible.

Estrella Insurance Operations to Franchises

If you’ve been considering joining the franchise revolution, Estrella Insurances is a great option. Estrella has been around since 2012, and in that time, they’ve built up a solid reputation with their customers and a loyal base of franchisees.

The franchise fees for Estrella are some of the lowest in the industry, with a one-time fee of just $25,000 to get started. The cost of operations, including rent, employee salaries, and insurance premiums, also tends to be lower than most other franchises.

When you become an Estrella Insurance franchisee, you’ll have access to all the systems and procedures that have made them so successful over the years. This includes training materials, customer service systems, and best practises that have been developed over time—plus ongoing support from the team at Estrella HQ.

And if you’re looking for additional revenue streams beyond the traditional insurance business, Estrella also offers products like credit protection plans and roadside assistance plans, which could be great additions to your portfolio.

So if you’re looking for an established company with low franchise fees and reliable operations, look no further than Estrella’ Insurance!

How is Estrella Insurance Territory Granted to Franchises?

Have you ever thought about joining the franchise revolution with Estrella’s Insurance? If so, one thing you might be wondering about is how the territory for each franchise is granted.

- Franchise agreement terms

The process of granting territories to franchises is outlined in the Franchise Agreement. The agreement states that Estrella will assign the applicant a geographic area in which they will operate, and the boundaries of that area will depend on several factors, such as population density, existing competition within that territory, and other economic factors.

The good thing is that Estrella’s Franchising Team will take all of these factors into account when determining which territory to grant to any particular franchisee. So if you’re looking to become a franchisee, rest assured that Estrella will make sure you get a fair share of customers within your territory!

- Consider All Factors

When it comes to assigning territories, the most important factor is what will bring in profits for both parties—Estrella and each individual franchisee. Choosing a territory wisely can mean great success for both parties involved, so make sure to consider all factors before entering into an agreement with Estrella.

What is the term of the franchise agreement and renewal?

If you’re looking to join the Estrella Insurance franc, then you should know that establishing a business agreement with us is a long-term commitment. Our franchise term of agreement lasts 10 years, and it’s renewable within 30 days before expiration.

- Franchise Cost

It’s important to note that the franchise fee for Estrella ‘s Insurance is typically $25,000. Additionally, there are other fees associated with this business agreement, such as royalties and advertising contributions. On top of that, you may also have to pay additional fees if you’re looking to open multiple locations.

- Franchise Review and Profit

You may have heard that Estrella Insurance franchisee owners are satisfied with their decision to join the revolution—and we don’t blame them! According to an independent survey conducted by The Entrepreneur Research Group, 82% of respondents reported profitability from Estrella Insurance. That’s why we put such emphasis on customer satisfaction—because in the end, it pays off!

Does Estrella Insurance provide financial assistance to franchises?

If you’re looking to join the Estrella Insurance Revolution, you might be wondering if you’re eligible for financial assistance.

The answer is yes! Estrella Insurance offers comprehensive financial assistance to all its potential franchisees. This includes:

- Access to credit and capital

- Commercial loan programs

- Assistance with start-up costs

- Support in securing insurance products

- Assistance finding alternative financing options

With Estrella Insurance’s financial assistance, you can get your business up and running in no time, so you can start enjoying the benefits of being your own boss and helping members of your community access the best insurance products available today.

Pros and Cons of Buying an Estrella Insurance Franchise

If you’re thinking of taking the plunge and investing in an Estrella Insurance franchises, you should consider the pros and cons. Owning a franchise isn’t for everyone, and there are some definite benefits and drawbacks.

- Pros

When you join Estrella Insurance, you are provided with strong, established brand recognition and all the materials needed to run your own successful business. You’ll have access to efficient systems and get the financial support needed to make your business thrive. You’ll also have the assurance of Estrella Insurance’s training staff, who can provide guidance and advice on how to best run your business.

- Cons

The cost of owning Estrella Insurance business can be quite hefty, as you’ll need to purchase supplies and equipment, pay for marketing costs, and rent a retail space. It’s also important to remember that you are essentially operating under a larger company’s guidelines, which can limit your creative freedom in running your business. Furthermore, since you’re essentially working with someone else’s brand, customers may not view your franchise as unique or different from other branches they visit.

What are Estrella Insurance franchise reviews?

Estrella Insurance has some great reviews, with many people commenting on how pleasant it was to work with the team.

The Estrella Insurance has been praised for

- Low start-up costs allow more people to join the franchise.

- variety of insurance products and services

- Competitive payouts and discounts

- Responsive customer service

- A dedicated team that offers personalised attention

- comprehensive training program

All these elements come together to make Estrella Insurance a great investment for potential franchisees, who can get started without making a huge financial commitment. With favorable reviews from existing franchises and a wide range of products and services on offer, this could be the ideal opportunity for you!

Estrella Insurance Rankings

Estrella Insurance has been recognised as a top franchisor and has been featured in Entrepreneur Magazine’s Top 500 from 2013 through 2020. The company was ranked #1 in the insurance category in 2014, 2015, and 2017.

Franchise Deck Analysis and Overview

Once you’ve decided to join the Estre franchise revolution, it’s important to do a thorough analysis of the franchise deck provided by Estrella Insurance. The analysis will help you understand the risks and advantages associated with this investment opportunity.

- Potential Risks

Before investing, consider the potential risks. Does Estrella Insurance offer enough support to help you get started? Is there a realistic chance of making a worthwhile profit? Are there any hidden fees or issues that need to be addressed? After all, it’s better to plan ahead than face an unexpected problem later on.

- Is the profit worth it?

You also want to consider if the estimated profits are worth the franchise cost. How much money is coming in compared to what is going out?

An important portion of your analysis should involve valid reviews from existing Estrella Insurance franchisees. Talk with investors who have lived through similar scenarios and use their insights as part of your decision-making process. After all, one person’s perception can be very different from another’s, so it’s best to get different perspectives before investing in a franchise opportunity.

Estrella Insurance Franchise Success and Failure Rate

The below table will highlight the Estrella franchise success and failure rate for the last 3 years. This will supplement your decision-making process.

| Year | Format | Start | End | Change |

| 2019 | Franchise Owned | 127 | 147 | +20 |

| Company Owned | 0 | 0 | 0 | |

| 2020 | Franchise Owned | 147 | 160 | +13 |

| Company Owned | 2 | 2 | 0 | |

| 2021 | Franchise Owned | 160 | 171 | +11 |

| Company Owned | 2 | 2 | 0 |

Competition Analysis of Estrella Insurance

| Estrella Insurance | Cost to Franchise | Franchisee Fees | Royalty + Ad fees | Expected Profit | Recoup of Capital | FD Rating |

| Estrella Insurance | $12,250 to $84,000 | $25,000 | 14%+7% | 10-25% | – | 3.5/5.0 |

| Sebenda Insurance Franchise | $57,300 – $86,500 | $30,000 | 12.5%+1.5% | – | – | 3.2/5.0 |

| Allstate InsuranceFranchise | $100,000 | $100,000 | – | 31.32% | – | 3.7/5.0 |

| Insurance Lounge Network Franchise | $100,000 | $10,000-$50,000, | 20%+2% | – | – | 3.4/5.0 |

| Brightway Insurance Franchise | $140,000 | $10,000 | – | – | – | 3.2/5.0 |

| Freeway Insurance Franchise | $60,000 to $100,000 | $15,000 | 15%+2% | – | – | 3.0/5.0 |

The Franchise Deck rating for the Estrella’ Insurance franchise is 3.5 /5.0.

Conclusion: Should You Buy the Estrella Insurance Franchise for Sale?

Now that you have all the information you need, it’s time to decide if the Estrella franchise is the right choice for you. There are numerous benefits associated with the Estrella Insurance franchise, from the relatively low cost to the great reviews from customers to the potential for ongoing success.

However, before making any big decisions, please take a few moments to consider some of the downsides as well. Estrella Insurance does require a significant financial investment upfront, and it may take a while before you start making any profits. Additionally, you will be operating on your own as an independent contractor rather than having dedicated employees or an internal team to help you manage your business.

Ultimately, whether or not the Estrella franchise is worth it is completely up to you and what fits your individual needs and goals best. Make sure to do plenty of research and ask around before coming to a final decision—good luck!

Entrepreneurs who want to open a franchise in the category retail insurance franchise opportunities categories can look at

- Sebenda insurance Franchise

- Allstate Insurance Franchise

- Insurance Lounge Network Franchise

- Brightway Insurance Franchise

- Freeway Insurance franchise

Frequently Asked Questions (FAQs)

You’ve heard all the talk about Estrella and its franchise opportunities, but you still have some questions. It’s understandable—investing in a franchise is a big decision, and you deserve to know what it takes. Here are some commonly asked questions and their answers to help you make your decision:

- Is the Estrella Insurance franchise profitable?

Yes, Estrella Insurance franchises have proven to be highly profitable for their owners. In addition to earning commissions from insurance policies sold, their products also offer significant discounts that customers can take advantage of in many states.

- Can you make money owning an Estrella policy?

Yes, there are many ways to make money with an Estrella Insurance franchises. From commissions on policies sold to discounts offered to customers, you can earn a significant income with this business model.

- Is Estrella Insurance a franchise?

Yes, Estrella Insurance is a franchised business model. The company has been operating since 2005 under the principle that customers should be able to purchase insurance on their own terms, which includes having options when it comes to price and coverage options.

- How much is an Estrella Insurance franchise?

The initial investment cost varies depending on the type of business you choose and other factors like location. However, it typically costs around $50K for a start-up plus ongoing costs related to marketing and operations support.

- How do Estrella Insurance franchisees make money?

Estrella franchises make money through commission-based sales of insurance policies as well as reductions in premiums that customers can take advantage of when they purchase certain policies from Estrella insurers.